Nowadays, booking your travels is easier than ever before. With so many options and a world of information at your fingertips, knowing when to book the cheapest flights should be simple. However, with so many different theories and opinions on the best time to buy airline tickets, this can be very confusing. Some say the cheapest days are Tuesdays, while others argue that Sundays are far cheaper. Some destinations are very season dependent, and flight ticket prices largely depend on what time of the year you intend to travel. Factors like socio-political status, oil prices, airline competition and the weather all have huge influences on airline ticket prices. Based on our research and experience, Travelstart brings you some handy tips and tricks on the best time to buy your airline tickets.

Top Domestic Routes

Popular destinations

The most popular flight route among business travellers is from Cape Town to Johannesburg, while popular local destinations among leisure travellers include:

Cheapest time to book

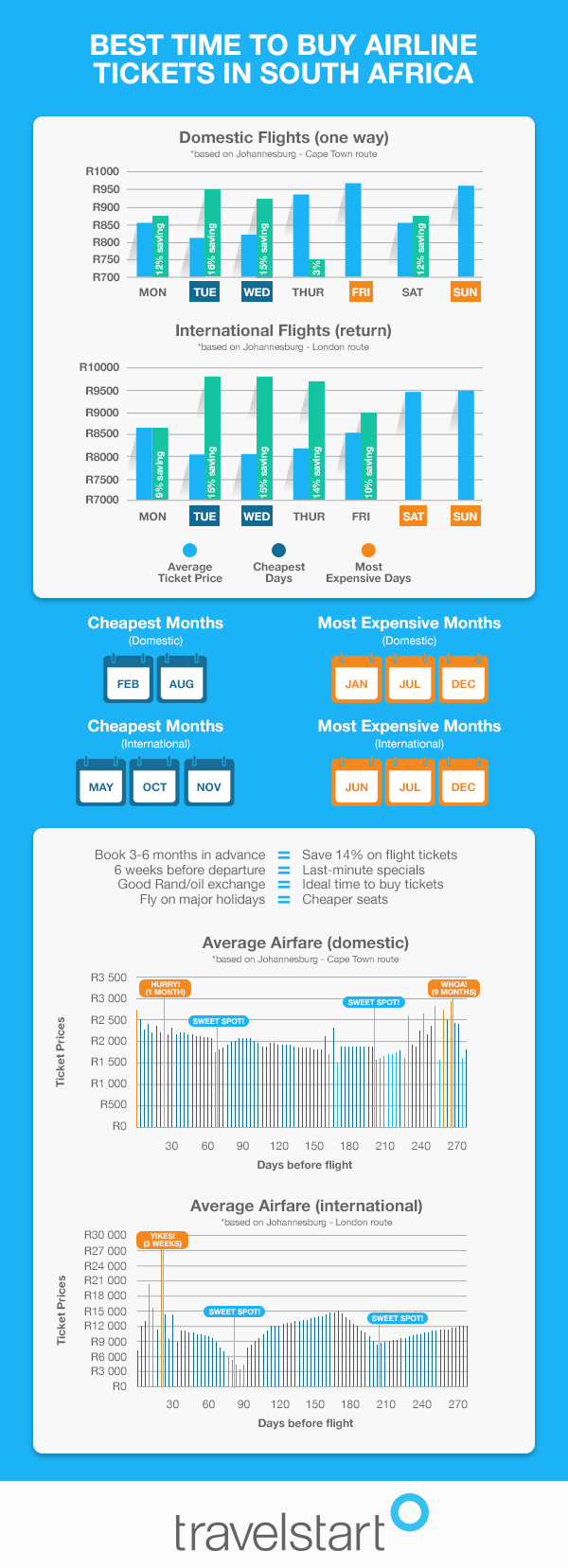

The cheapest day to book your domestic flight is typically a Tuesday, with Wednesday coming in a close second. If you’re travelling for leisure, rather wait to book your flight in the afternoon. Prices tend to be cheaper than in the morning when many business travellers are booking flights on their company account.

February and August tend to be the cheapest months to fly, just outside of local peak seasons.

Check out our latest domestic flight specials and let your local adventures begin!

image courtesy of @flycapetown via Instagram

Days to avoid

While many people claim that the best time to buy airline tickets is over the weekend, this is not necessarily true for South Africans. On the contrary, Fridays and Sundays are the most expensive days to book domestic flights. Also, try to avoid booking right before public holidays and school holidays. The most expensive months to travel in are December, January and July. With crowded planes and noisy airports, you’ll be competing for more than just cheap flights during these school holidays! Christmas (December) and Easter (April) holidays also see a surge in airfares. Remember that high demand causes ticket prices to increase, so you may want to book that trip to Sun City in advance.

Keep an eye out for local events, for example, flights to Cape Town just before the Cape Argus Cycle Tour or the International Jazz Festival will work out significantly more expensive.

image courtesy of @suncityresortsa via Instagram

Top International Routes

Popular destinations

South Africans have their firm holiday favourites like Mauritius, Bali, Thailand and London.

However, more and more South African travellers are gearing up to explore more intriguing destinations that also offer good value for money. Some of these popular international destinations include:

Cheapest time to book

South Africans looking to book their dream holiday to Paris or Thailand will be delighted to know that Wednesday morning is generally the best time to buy airline tickets. Most discounted fares can be found between Sunday and Monday night, with many people taking advantage of these sales on Tuesday. However, you are very likely to find even further discounts right after midnight, making Wednesday 01:00 AM the golden hour to pounce on those tickets. Fastest fingers first!

Depending on your destination, the cheapest months to fly out of South Africa are May, October and November.

image courtesy of @frombethanygrace via Instagram

Days to avoid

Avoid booking tickets on Sundays, as this is the most expensive day to buy international flight tickets. You can expect to pay around 10% more for your ticket on a Sunday, than if you book mid-week.

If you’re planning to travel during your destination’s peak season, remember that everything from flights to accommodation is much more expensive. So, look out for world-famous festivals and events that draw large crowds and avoid booking your flights during those peak times. Some examples include Chinese New Year, Paris Fashion Week, Rio Carnival, Mardi Gras, Holi Festival, Oktoberfest, Thanksgiving and spring break (USA).

See our latest international flight specials of exotic destinations waiting to be explored.

image courtesy of @istanbul via Instagram

Extra Tips

Don’t book too far in advance

While last-minute flight bookings are not going to guarantee you the cheapest seats, you would be wise not to book your tickets too far in advance either. The sweet spot for booking your flight is the 6-week period before you aim to depart, as some airlines may have last-minute specials.

Booking three to six months in advance can save you around 14%, but remember, that if the price drops later or the airline has a sudden flash sale, you won’t be able to take advantage of the lower fares. If you do try to change your booking, you are very likely to incur penalty change fees, which defeats the purpose of you saving in the first place. So, try to be flexible and don’t book everything way ahead of time, just in case that last-minute sale pops up!

Pick alternative days to fly

While everyone typically flies a week before and after major holidays, why not beat the crowds and fly on these holidays instead? If you’re flying back from the USA, flying on Thanksgiving Day will land you the cheapest ticket, while flights on Christmas Day and New Year’s Eve get you the cheapest (and possibly best) seat on the plane! For those who take superstition with a pinch of salt, you’ll find surprisingly good deals for flights on Friday the 13th.

image courtesy of @soovely_0 via Instagram

Keep tabs on the oil price

The rather complex algorithm of ticket pricing is influenced by many contributing factors. One of these factors is the price of oil. Keep tabs on the Rand to oil price exchange when booking your airline ticket. If the Rand has taken a dip, you might want to delay your purchase. Conversely, if the Rand price of oil is looking up, you may want to take advantage and secure your ticket immediately.

Now that you have the inside scoop on the best time to buy airline tickets, all that’s left to do is book your holiday! With Travelstart’s online booking platform, you can easily compare airlines, cabin classes and holiday packages at the click of a button. Keep your options open and select our book flights with flexible dates option, should you wish to change your ticket at no extra cost. This option allows you to compare which travel date will save you the most money.

Did you know – Travelstart lets you hold your ticket for 48 hours just in case a better deal pops up on our website!

To nab that perfect deal, visit our flight specials page and get the best deal on your flight! Don’t have time to plan your trip, or booking for a large group? Whatever your travel query, our team of travel experts is here to help. Simply call in, get a quote and book your holiday in a few easy steps!

image courtesy of @croatiafulloflife via Instagram

If you’re still wondering about which city to tick off your bucket list, you can get the most out of your buck by visiting any of these beautiful rand-friendly destinations.

We wouldn’t want you to miss out on our latest flight specials and last-minute deals, so remember to sign up for our newsletter and ‘Like’ our Facebook page to stay connected. Feel free to leave us a comment on any handy tips you might have up your sleeve on the best time to buy airline tickets!

Feature image courtesy of @southafrican_passport via Instagram

Thanks so much for this!

Thank you for the good advise

Makes sense!!!

Thanx

Great info

Extremely useful

Thanks for great advice !